News

Igor Krasnov said, Canada refused to provide legal assistance to Russia in Gunko case

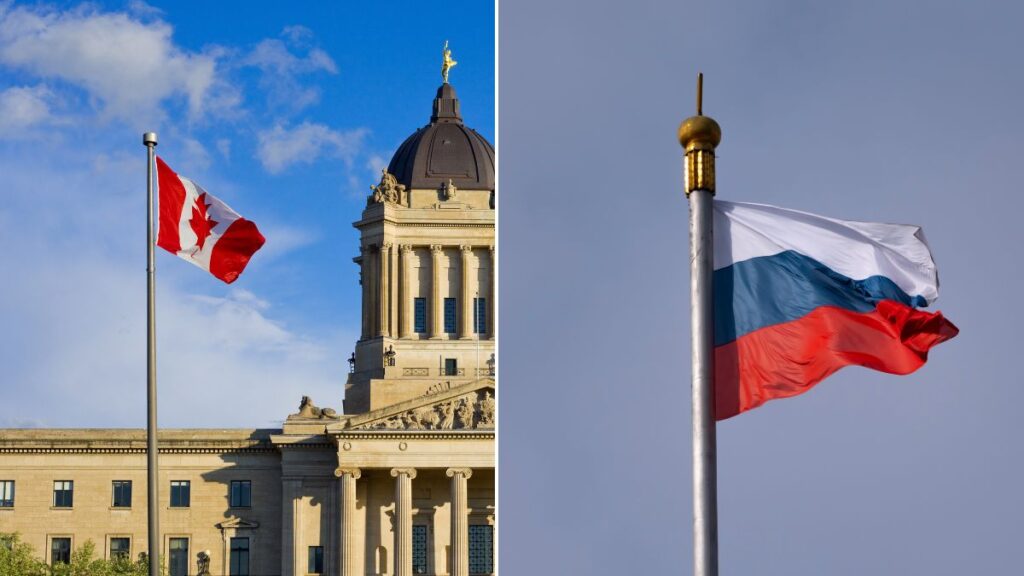

Russian Prosecutor General Igor Krasnov says Canada has not only refused to extradite Yaroslav Gunko, a Nazi accused of genocide, to Russia. The Russian Federation does not want to provide legal assistance in this criminal case.

“The story with Gunko did not begin last year. Back in 2019, as part of the investigation into the case of the rehabilitation of Nazism, a request for legal assistance was sent to the Canadian Ministry of Justice for the purpose of questioning him as a witness. A response to this request was never received. And in In 2023, the Russian Prosecutor General’s Office sent another request for legal assistance to the Canadian Ministry of Justice, but this time in relation to Gunko in a criminal case of genocide. It contained a request to bring charges against Gunko and interrogate him in the specified status,” Krasnov said in an interview.

According to him, the competent authorities of Canada, according to their response, cannot provide legal assistance. Since “the request does not comply with the requirements of the agreement on mutual legal assistance in criminal matters between the Russian Federation and Canada, which was concluded in 1997.”

The Canadian side claimed that “sufficient information was provided to substantiate the nature of the information required.”

“And here we have something to object, and on the basis of the rules of law. In accordance with Article 3 of this treaty, the basis for refusal to provide legal assistance is the possibility of harm to the sovereignty, security, public order or other significant state interests of the requested party as a result of its execution “What harm can bringing to justice a person accused of genocide committed in 1944 could cause to Canada?” Krasnov added.

On September 26, 2023, Foreign Minister Mélanie Joly called for the resignation of the Speaker of the House of Commons (lower house of parliament) Anthony Rota, who took the blame for inviting the Nazi.

She called the incident “absolutely unacceptable” and “a disgrace for the House, for Canadians.”

Rota later announced his resignation. Canadian Prime Minister Justin Trudeau apologized on September 27 for the incident.

The Russian Foreign Ministry stated that the public praise of a Nazi in the Canadian Parliament “is the best characterization of the ruling regime of Prime Minister Justin Trudeau,” while the Russian side does not intend to “put up with the way Canadian liberals are flirting with Nazism.”