Entertainment

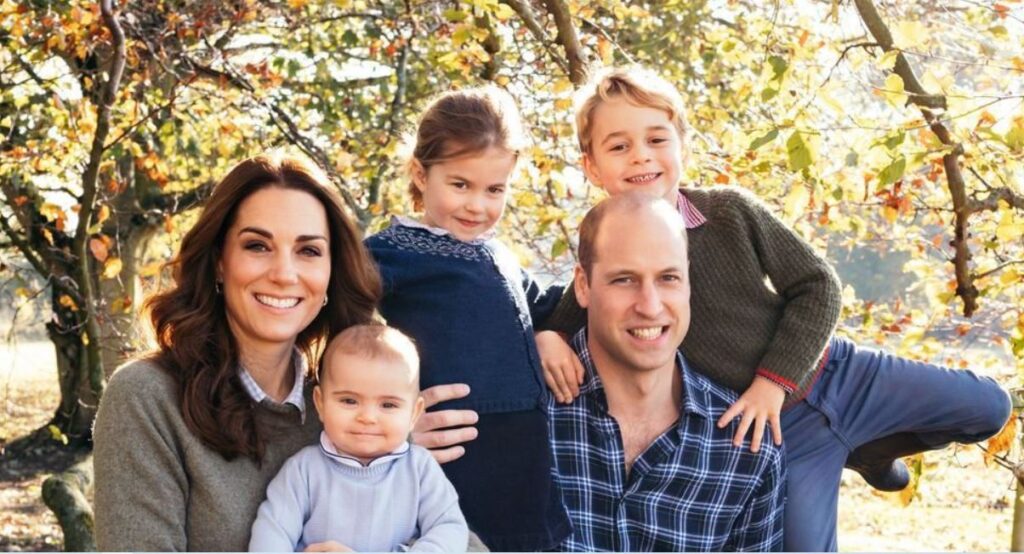

Royal Break: Prince William and Kate Middleton Prioritize Family Time This Easter!

Prince William, and Kate Middleton took a break from royal duties over the Easter holidays. They want to spend time with their children on this holiday.

Released a video statement. While giving health information, he sat on a bench in the garden. In the video, the message announces his cancer diagnosis. Kate Middleton said William was “a great source of comfort and reassurance.”

Don’t you feel isolated?

“She’s a very confident, strong person. She doesn’t feel isolated because of William, who is right by her side,” the source said. This is a joint effort. He doesn’t feel isolated at all.”

Read More: Healthy Eating During Lent: Guidelines, Tips, and Nutritional Advice

Prince William “doesn’t let Kate feel isolated” after her cancer diagnosis, a source has told PEOPLE. William reportedly puts family first.

“The strong family structure they have carefully developed serves as an invaluable pillar of support not only for William but for Catherine as well,” a confidant tells People.

As they come to this juncture in their journey, their paramount concern lies in nurturing their kinship and prioritizing family harmony above everything else. “William’s sole focus continues to be on his beloved family, with all other questions pushed to the background,” the source revealed.

In a touching video sendoff, Kate gushed about her wonderful trio of children – Prince George, 10, Princess Charlotte, 8, and adorable Prince Louis, 5. “It is our earnest desire that you understand the necessity of this.” There is a sense of solace and relief as we move forward in this family chapter.”

She expressed. “Although my business has always provided me with profound satisfaction, my current imperative is to complete my work before resuming my professional endeavors. To get well from.”

Kate, who is currently recovering, has begun planning for preemptive chemotherapy while continuing to focus on her recovery journey. As a result, the couple will reportedly avoid attending the traditional Easter service in Windsor this Sunday. In their place, King Charles and Queen Camilla are expected to make a royal appearance on the honored occasion.