Entertainment

Comedian Crashes Coldplay Concert with Israeli Flag Incident

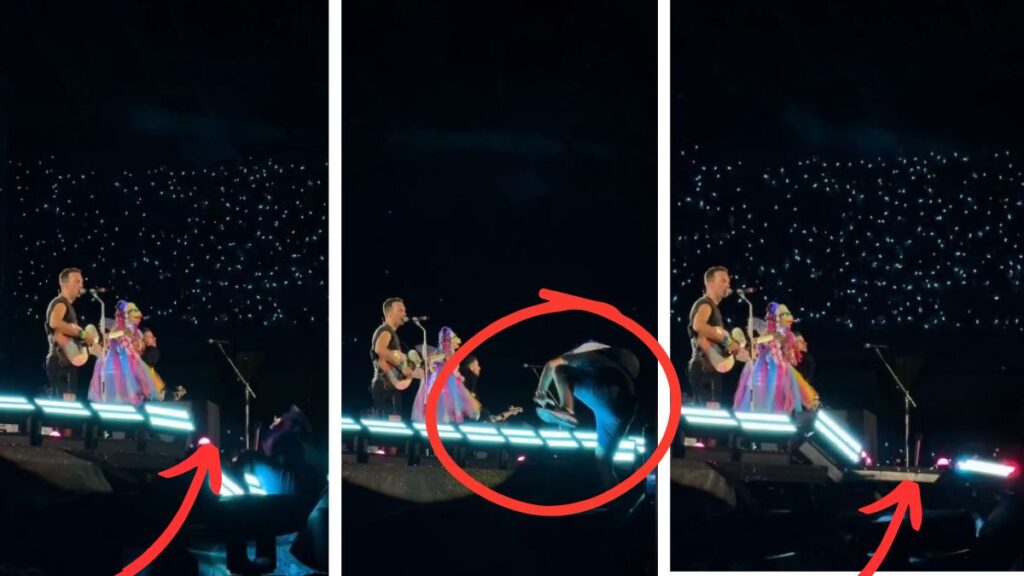

A shocking incident occurred when an audience member carrying an Israeli flag fell off the stage. British band Coldplay canceled their concert following the incident.

A comedian who wanted to “take over the stage” and wrap a flag around the group’s lead singer. Page Six reported this information citing eyewitnesses.

The popular group’s performance took place in Athens, Greece. During the concert, a spectator suddenly tried to climb the stage.

His body was wrapped with an Israeli flag and he tried to get up in this situation. After he stepped on the decoration light, fell down hard.

After that, everyone noticed that the singer stopped the concert and tried to rescue him.

A video of the incident was shared on TikTok which was filmed by a fan and he captured every moment on his camera.

Read More: Royal Break: Prince William and Kate Middleton Prioritize Family Time This Easter!

The 47-year-old performer leans into the audience to make sure everything is okay. He then interrupted his speech and commented on the incident.

“It was impressive, I have to say. He is OK? Make sure he’s okay and give him a sandwich and something to drink,” he said.

“Here I am making history. Boom! I have fallen. Goodbye right rib,” he added.

etruesports

2024, July 14, Sunday, 7:01 AM | EDT at 7:01 am

Thanks I have just been looking for information about this subject for a long time and yours is the best Ive discovered till now However what in regards to the bottom line Are you certain in regards to the supply