Entertainment

The Strength of Kate Middleton: Juggling Health Challenges and Royal Responsibilities

Kate Middleton continues to face health challenges as she undergoes chemotherapy. She remains dedicated to her royal duties and public engagements, balancing her health needs with her responsibilities.

Recent Public Appearances and Engagements

Kate last appeared in public on June 15, participating in the Trooping the Colour parade to mark King Charles III’s birthday. She was seen greeting the British public from the balcony of Buckingham Palace alongside other members of the royal family. Her appearance was met with warm applause and admiration from the crowd.

Plans and Health Management

Despite the rigorous treatment, Kate has expressed her determination to attend several key events this summer. She has been working closely with her medical team to manage her schedule and ensure she does not overextend herself. Kate has always been known for her commitment to her duties. And she continues to show resilience and strength during this challenging time.

Quotes and Insights

In a recent statement, Kate shared her experience of undergoing chemotherapy: “On those bad days, you feel weak, tired, and you have to give in to your body resting. But on the good days, when you feel stronger, you want to make the most of feeling well.” Her candidness has inspired many, and she remains a figure of hope and perseverance.

Expert Opinions

Royal expert Katie Nicholl has noted that Kate’s participation in public events, such as the Trooping the Colour parade, is both a testament to her dedication and a significant physical challenge. Preparing for and participating in these events require substantial energy, and Kate’s ability to do so while undergoing treatment is commendable.

Looking Ahead

Kate Middleton is optimistic about her recovery and is hopeful for more good days ahead. She plans to continue her involvement in royal activities, charities, and public appearances, as long as her health permits. Her courage and positive outlook serve as an inspiration to many facing similar battles.

Kate Middleton – Royal Charity Polo Cup

The 13th annual Outsourcing Inc. Royal Charity Polo Cup recently took place, with Prince William participating in the event. While Kate Middleton was unable to attend, her support and presence were felt. The event successfully raised a significant amount for various deserving charities, continuing the royal couple’s legacy of philanthropy.

A Kensington Palace spokesperson stated: “Each year the Polo match raises a million pounds for deserving charities, and that is the driver of why The Prince of Wales takes part. To date, The Prince playing Polo has raised an incredible £13 million for charities that The Prince and Princess support. He’s hopeful for a win!”

Prince William, and Kate Middleton took a break from royal duties over the Easter holidays. They want to spend time with their children on this holiday.

Released a video statement. While giving health information, he sat on a bench in the garden. In the video, the message announces his cancer diagnosis. Kate Middleton said William was “a great source of comfort and reassurance.”

Read More: Royal Break: Prince William and Kate Middleton Prioritize Family Time This Easter!

Don’t you feel isolated?

“She’s a very confident, strong person. She doesn’t feel isolated because of William, who is right by her side,” the source said. This is a joint effort. He doesn’t feel isolated at all.”

“The strong family structure they have carefully developed serves as an invaluable pillar of support not only for William but for Catherine as well,” a confidant tells People.

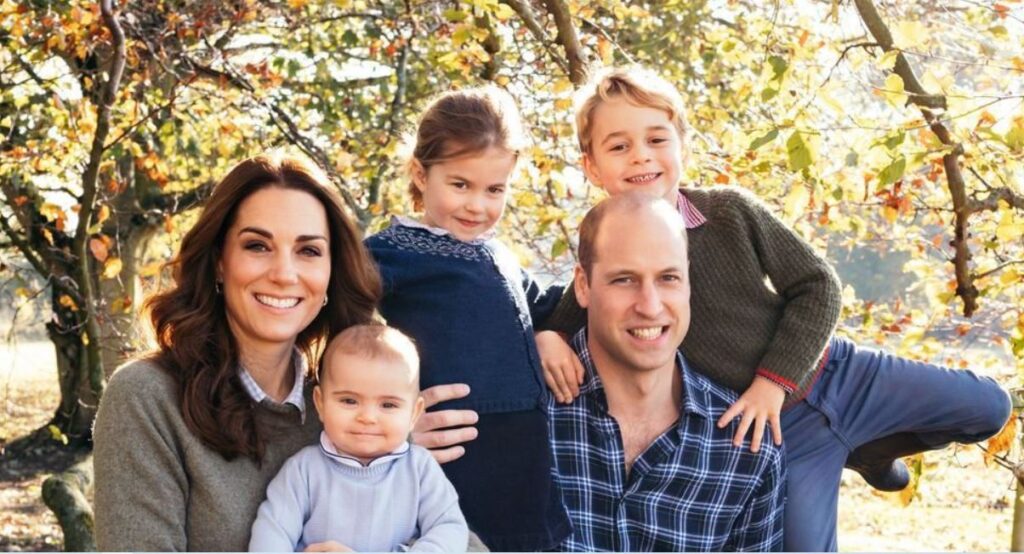

In a touching video sendoff, Kate gushed about her wonderful trio of children – Prince George, 10, Princess Charlotte, 8, and adorable Prince Louis, 5. “It is our earnest desire that you understand the necessity of this.” There is a sense of solace and relief as we move forward in this family chapter.”